CLIENT OVERVIEW

A multinational company, based out of UK and Asia, with 5000+ employees aimed to boost financial wellness by offering early access to earned wages.

THE OPPORTUNITY

A lot of employees had expressed their concerns with financial wellness and needed access to wages before payday for emergencies or daily expenses. Fixed monthly payroll cycles were adding to the financial stress of the employees. The client, as an employer required automation, compliance, and minimal overhead to provide employees with the option to take early pay or small loans against salary.

OUR APPROACH

NeoQuant took up the challenge with the aim to empower financial freedom and reduce burden of the employees in need of immediate finances. It was also important to map the eligibility and number of transactions permitted. Maker-checker availability was a must to ensure that there was two-factor-authentication for all requested transactions.

WHAT WE BUILT TOGETHER

We implemented our ‘Early Payday: A comprehensive solution designed to address immediate financial needs.’ A business rule engine was integrated to calculate eligibility for accessing funds for all the employees, offering them a part of the paycheck, before the payday.

TECHNOLOGY USED

Architecture: Microservices | Frontend: Angular | Database: Mssql version 7 | Backend: DotNet Core

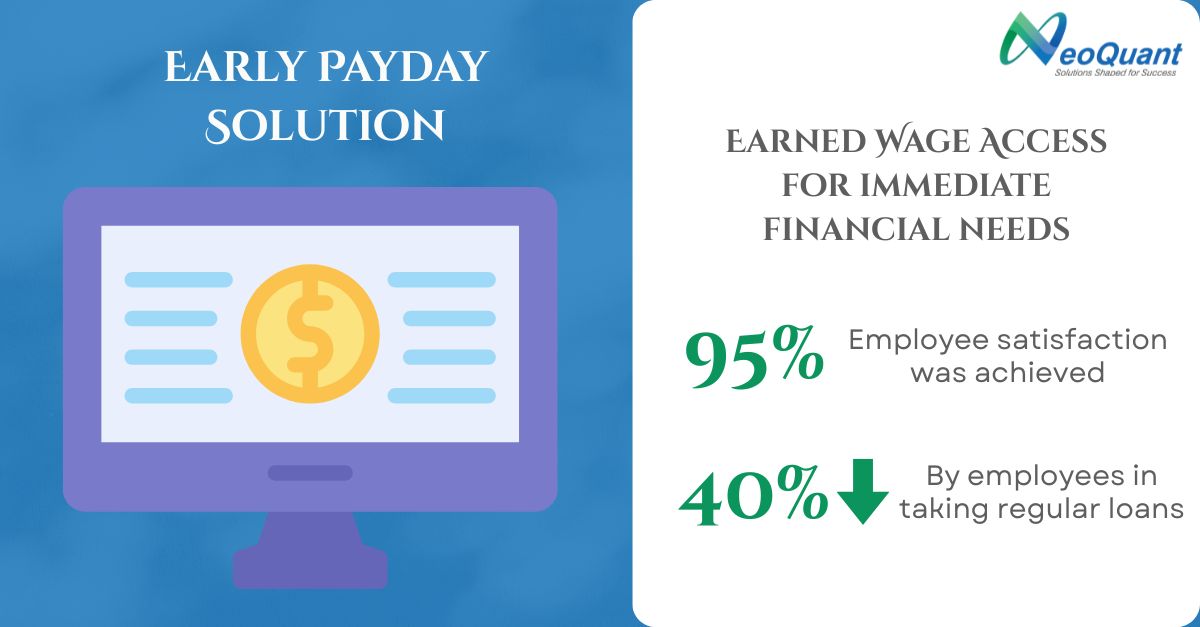

THE BUSINESS IMPACT

After implementation of this solution, it was surveyed that the client has achieved 95% employee satisfaction.

By leveraging Early Payday, the client noted a significant 40% drop amongst employees in regular loans.

NeoQuant was able to efficiently manage the payroll integration in line with compliance.