Blogs

Introduction

If there’s one thing banks, insurers, and financial institutions have always known, it’s that relationships drive loyalty. But over the years, the way customers expect to interact with their providers has changed beyond recognition. The customers now expect faster responses, tailored advice, and communication that feels relevant. Data and AI are no longer hidden in the background; they sit at the centre of this new reality, helping BFSI companies anticipate needs, personalize engagement, and earn customers’ trust at scale. In this blog, we’ll see exactly how AI and Data are Shaping Financial Services.

Evolution of Customer Engagement in Financial Services

For decades, customer interaction in financial services was mostly transactional. A customer would visit the bank to open an account, call an agent for a loan query, or reach out to their insurer only at renewal time. Brokerages often communicated just as much as quarterly statements.

This model worked when competition was limited. However, three major shifts made it outdated:

With digital-first companies raising expectations, BFSI institutions can no longer afford a one-size-fits-all approach. If entertainment apps can predict what movie you’ll like, why shouldn’t your bank anticipate your next financial move? This is where data and AI-driven engagement begin to redefine customer relationships.

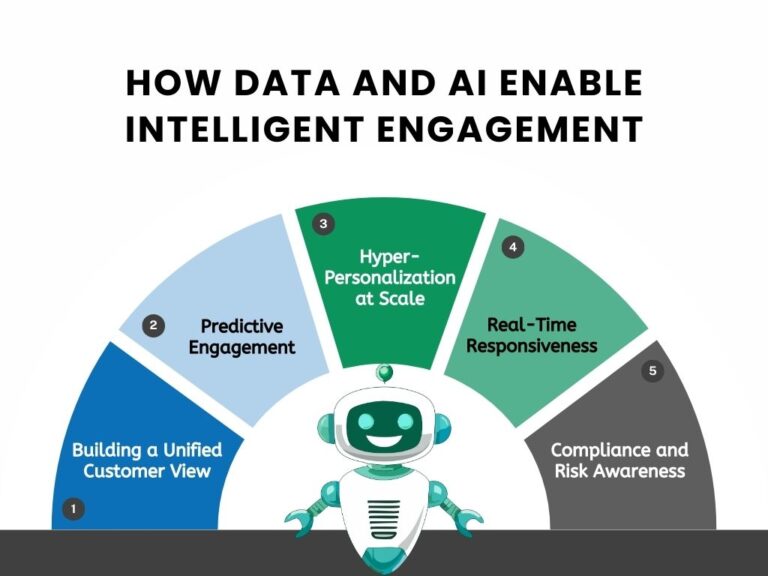

How Data and AI Enable Intelligent Engagement

Case Study: Building a Customer 360 Support & CX Portal

At NeoQuant, we partnered with a leading bank struggling with fragmented customer engagement.

Five Lessons for BFSI Institutions

The Role of AI in Content and Communication

Numbers alone don’t create loyalty, communication does. AI enhances this by:

When applied well, AI makes communication feel more human, not less.

What’s Next: The Future of AI in BFSI Engagement

Three key trends are shaping the future:

The firms that adopt these capabilities early will set the standard for the industry.

Conclusion

The future of financial services won’t be defined only by products or interest rates anymore. It will be shaped by how well institutions listen, respond, and adapt to customer expectations. Data and AI give BFSI firms the tools to move from one-size-fits-all communication to meaningful, timely, and predictive engagement. Those that strike the right balance between technology and human connection will not just keep pace but also be the ones to lead the industry forward.